Donate/Pledge Today!

Please remember your gift is tax-deductible and your support ensures that programs continue to grow to meet the needs of our talented students. Matching Gifts are often available from employers’ matching gift programs and can double or even triple your contribution. Please call the Advancement Office (203) 362-2569 or the Business Office (203) 362-2561 for assistance. Thank You!

The Annual Fund for Unquowa

The Annual Fund for Unquowa

The Fund for Unquowa is a vital part of Unquowa’s financial health that consists entirely of gifts from parents, grandparents, alumni and our broader community.

It contributes to the school’s academic excellence by financially backing cutting-edge curriculum updates and innovative training opportunities for teachers. And it enables our school to have the socio-economic diversity so valued by our parents by helping provide financial aid.

The Fund also supports student artistic development as demonstrated by productions such as WinterFest, spring musicals and visual art projects such as Voices of Change. In addition, it helps provides regular updates to our campus and technology, visits from influential thinkers and enhanced experiential opportunities that preserve our children’s love of learning.

We ask that you support and celebrate Unquowa with a personally meaningful gift to the Annual Fund for Unquowa. Please consider amounts of $100, $1,000, $10,000 or highlight Unquowa’s founding with a gift of $1,917.

Warm regards,

Melody Waterhouse & Robin Pompa, Fund for Unquowa Co-Chairs

Mail Your Donation:

Check Payable to The Unquowa School

Send to:

The Unquowa School

981 Stratfield Rd.

Fairfield, CT 06825

ATTN: Business Office

Making a Gift of Securities to The Unquowa School

Your support of The Unquowa School ensures that programs continue to grow to meet the needs of our talented students. For many donors, making a gift of securities is an ideal way to support our school. Below are the instructions to transfer stock electronically.

Instruct your broker to transfer shares you wish to give to The Unquowa School’s brokerage account.

Please contact our Business Manager, Janice Cerone, via email janice.cerone@unquowa.org before initiating a stock transfer. Please provide the stock name and number of shares in order to track and confirm your gift.

Wire Cash Transfers

Below are the instructions to transfer cash gifts electronically. Please contact our Business Manager, Janice Cerone, via email janice.cerone@unquowa.org before initiating a cash wire transfer.

Incoming Wire Instructions:

Bank Name: U.S. Bank

Bank Address: 800 Nicollet Ave, Minneapolis, MN 55402

ABA Number: 091000022

Account Name: RBC Capital Markets, LLC

Account Address (if applicable): 250 Nicollet Mall, Minneapolis, MN 55401

Account Number: 160230097208

Further Credit: Unquowa School Association, Inc.

Further Credit: 325-76267

Incoming Share Instructions:

DTC Eligible Securities # 0235 FBO Unquowa School Association, Inc. 325-76267

Thank you for supporting The Unquowa School!

The Carl Churchill Legacy Giving Society

In thinking about establishing our Legacy Giving Society, there were many decisions to make, but one thing was perfectly clear from the start. As a key component of securing the school’s future, it had to be named for the school’s longest sitting headmaster, Carl Churchill, whose twenty year tenure shaped the early years of the school’s history and laid the firm foundation for its progressive philosophy. Mr. Churchill understood and put in place at Unquowa the progressive education model of learning by doing, evidence of which we see in vintage photos that grace our halls today and the practice of which continues to grow each year at Unquowa.

In the annual report of 1940, Mr. Churchill wisely emphasized the counterintuitive notion that parents should not save their money for boarding school and college but rather spend it on the early years of their child’s education “to induce the habit of mental exploration, discovery and achievement” that would serve them through life. We cannot thank Mr. Churchill enough for the clear, steady path he laid for his successors, a path which has allowed our school to near its 100th anniversary providing the robust, impactful educational experience for children that Mr. Churchill worked so long and so hard to establish.

Overview of Legacy Giving

Legacy Giving is a way for you to support The Unquowa School through a long term strategy of directed giving that benefits both you and the school for years to come.

While any gift to the school provides vital support, a planned legacy gift offers a unique level of long-term security that strengthens Unquowa’s financial foundation for the future. As with all giving to the school, you have the option of directing your legacy gift towards an area at the school that you are passionate about or leaving it unrestricted for the school’s leadership to determine where it is needed most.

The legacy giving tools described below each offer a different path that you can take to support Unquowa while providing possible tax and inheritance benefits to you and your family.

While Unquowa can accept and monitor the legacy giving strategies included here, the school is not in a position to provide financial advice. Therefore, if you are considering making a gift to the school through one of these strategies, we suggest you discuss these options with your financial advisor.

Together we are making Unquowa stronger for the students who are here now and for those who will join the Unquowa family in the future. On behalf of all of them, thank you.

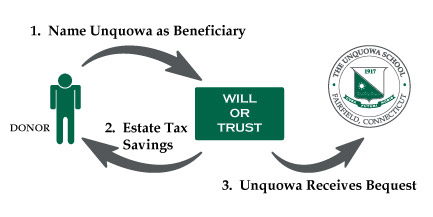

Gifts From Your Will or Trust : This gift does not affect your cash flow during your lifetime, and provides significant support to The Unquowa School.

How it works…

- Include a bequest to The Unquowa School in your will or trust

- Make your bequest unrestricted or direct it to a specific purpose at the school

- Indicate a specific amount, a percentage of your estate, or a portion of the balance remaining in your estate or trust

Benefits…

- Your assets remain in your control in your lifetime

- You can modify your bequest to address changing circumstances

- Receive a deduction in estate taxes for your charitable bequest

- You can direct your bequest to a particular purpose

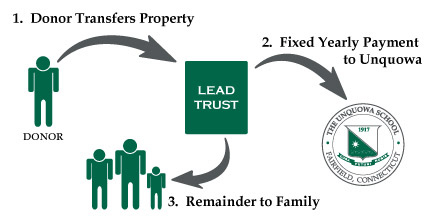

Charitable Lead Trusts : This gift allows you to provide significant annual support to The Unquowa School now, while reducing the taxes on assets passed to your heirs later.

How it works…

- You contribute securities or other appreciating assets to a charitable lead trust

- The trust makes annual payments to The Unquowa School for a period of time

- When the trust terminates, the remaining principal is paid to your heirs

Benefits…

- The present value of the income payments to The Unquowa School reduces your gift/estate tax

- All appreciation that takes place in the trust goes tax-free to your heirs

- The amount and term of the payments to The Unquowa School can be set so as to reduce or even eliminate transfer taxes due when the principal reverts to your heirs

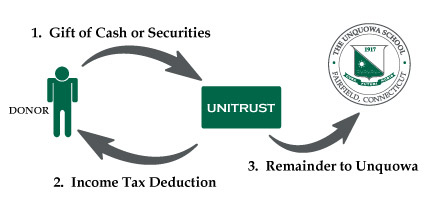

Charitable Remainder Unitrusts : This gift benefits you and your designated beneficiaries now and The Unquowa School later on and for years to come.

How it works…

- You transfer cash, securities or other appreciated property into a trust

- The trust pays a percentage of the value of its principal, which is re-valued annually, to you or to beneficiaries you name

- When the trust terminates, the remainder passes to The Unquowa School to be used as you have directed

Benefits…

- You or your designated beneficiaries receive income for life or for a term of years (varies annually based on the value of the trust)

- You receive an immediate income tax deduction for a the charitable remainder value of your gift

- Pay no upfront capital gains tax on appreciated assets you donate

- You can make additional gifts to the trust as your circumstances allow for additional income and tax benefits

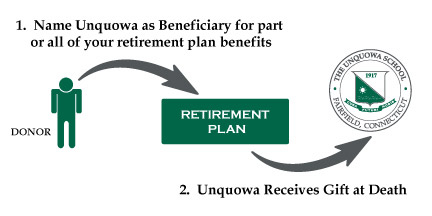

Gifts from Retirement Plans at Death : This gift supports The Unquowa School and its students for years to come.

How it works…

- You name The Unquowa School as beneficiary for part or all of your retirement-plan benefits

- Funds are transferred by plan administrator at your death

Benefits…

- No federal income tax is due on the funds that pass to The Unquowa School

- No federal estate-tax liability

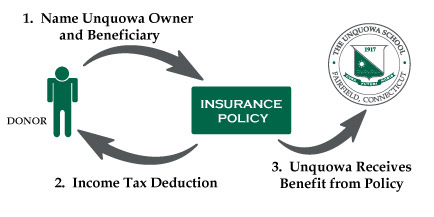

Gifts of Life Insurance : This gift allows you to provide significant support to The Unquowa School without adversely affecting your cash flow.

How it works…

- You transfer ownership of a paid-up life insurance policy to The Unquowa School

- The Unquowa School cashes the policy now

Benefits…

- You receive gift credit and an immediate income tax deduction for the cash surrender value of the policy